So as discussed in the earlier post, we will go further into this post for understanding Costing Variant.

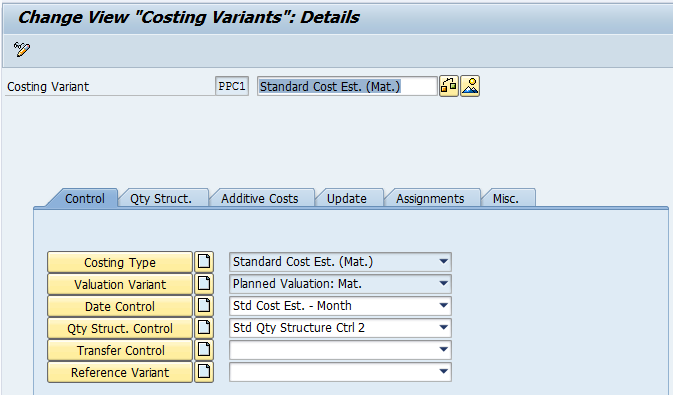

If we carefully give a look at the following image of Costing Variant, we can easily notice that the Costing Variant is basically divided into 6 logical tabs (or parts, we may say). SAP has done this in order to simplify and at the same time to provide more flexibility in product costing.

With the discussion under this and upcoming posts, we will try to look into each and every component under all the tabs separately to facilitate deeper understanding.

Also please note that for our understanding and analysis purpose, we will be considering the Costing Variant PPC1 and will try to discuss about others, once we are through with PPC1.

If we carefully give a look at the following image of Costing Variant, we can easily notice that the Costing Variant is basically divided into 6 logical tabs (or parts, we may say). SAP has done this in order to simplify and at the same time to provide more flexibility in product costing.

With the discussion under this and upcoming posts, we will try to look into each and every component under all the tabs separately to facilitate deeper understanding.

Also please note that for our understanding and analysis purpose, we will be considering the Costing Variant PPC1 and will try to discuss about others, once we are through with PPC1.

In this post, as the heading of this post suggests we will look into the Costing Type component of Costing Variant:

Before we go ahead, first let's go through the IMG Path required to be followed for creation of Costing Type

IMG > Controlling > Product Cost Controlling > Product Cost Planning > Material Cost Estimate with Quantity Structure > Costing Variant: Components > Define Costing Types

We will first start with the brief understanding of what is a Costing Type? But before that we will first understand how this Costing Type is structured (Note: SAP comes with various Costing Types, but for our understanding as said earlier we will consider Costing Type 01 assigned to Costing Variant PPC1 here)

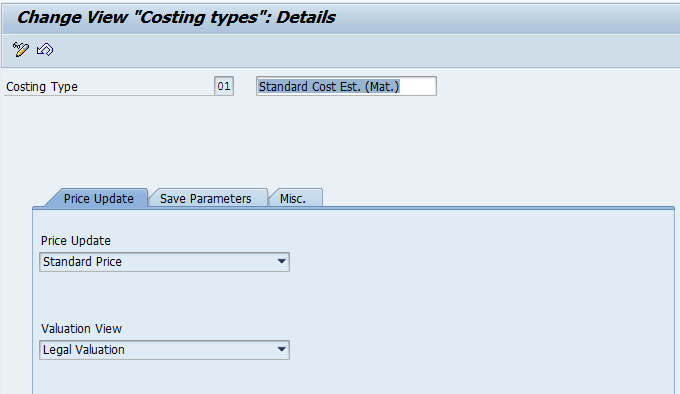

In the following image, we can see the three tabs available under Costing Type.

This bifurcation in Costing Type is done by SAP to provide further flexibility at the most granular level possible. At the same time, we need to exercise caution while customising in order to not do too much in an attempt to achieve everything. In this world, nobody can get everything ;)

On this positive note we will continue our discussion on Costing Type.

Let's go through the tabs one by one:

Tab: Price Update

Before we go ahead, first let's go through the IMG Path required to be followed for creation of Costing Type

IMG > Controlling > Product Cost Controlling > Product Cost Planning > Material Cost Estimate with Quantity Structure > Costing Variant: Components > Define Costing Types

We will first start with the brief understanding of what is a Costing Type? But before that we will first understand how this Costing Type is structured (Note: SAP comes with various Costing Types, but for our understanding as said earlier we will consider Costing Type 01 assigned to Costing Variant PPC1 here)

In the following image, we can see the three tabs available under Costing Type.

This bifurcation in Costing Type is done by SAP to provide further flexibility at the most granular level possible. At the same time, we need to exercise caution while customising in order to not do too much in an attempt to achieve everything. In this world, nobody can get everything ;)

On this positive note we will continue our discussion on Costing Type.

Let's go through the tabs one by one:

Tab: Price Update

This tab contains configuration related to updating the results of cost estimate and is divided into following two parts:

Price Update

Under this tab we define where the price calculated during the cost estimate should be updated by the system. In the above image (Screen-1) we can see that the standard Costing Type updates Standard price. This in other words mean, when a material cost estimate is released, it will update standard price in material master.

Following options are made available by SAP for updating the results

Note: We also need to keep in our mind that standard system contains costing types that write to the material (standard price), and hence the system does not allow to create our own costing types to do this i.e. updating standard price.

Valuation View

You use valuation views to represent different ways of viewing business transactions in a company.

Now lets go to the next tab:

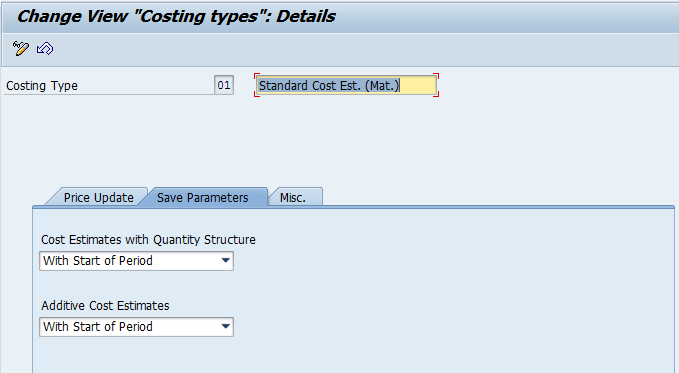

Tab: Save Parameters.

Price Update

Under this tab we define where the price calculated during the cost estimate should be updated by the system. In the above image (Screen-1) we can see that the standard Costing Type updates Standard price. This in other words mean, when a material cost estimate is released, it will update standard price in material master.

Following options are made available by SAP for updating the results

- Standard Price

- Tax-Based Price

- Commercial Price

- Prices other than standard price

- No Update

Note: We also need to keep in our mind that standard system contains costing types that write to the material (standard price), and hence the system does not allow to create our own costing types to do this i.e. updating standard price.

Valuation View

You use valuation views to represent different ways of viewing business transactions in a company.

Now lets go to the next tab:

Tab: Save Parameters.

This tab contains configuration related to updating dates when the cost estimate is saved and is divided into following two parts:

Cost Estimate with Quantity Structure

Here we have to select whether the date will be saved in standard cost estimate and following options are available for us to opt from:

This part becomes very important in case of product cost collect and hence, SAP has provided separate Costing Type for Product Cost Collector which contains relevant configuration to be opted for. Hence, it also becomes very important to identify the requirement and try to find if any standard costing type or costing variant is provided by SAP for the scenario (in most of the cases you will find the answer as YES) and if yes, go for it. If you do not find appropriate standard configuration, take a cautious approach while customising.

Note: For the standard cost estimate, you must update automatic costing with the With start of period indicator. This ensures that the results of the standard cost estimate can be used as the standard price for that period. For the other costing types, you can update the costing results with the With date indicator, for example. In this case the current date becomes part of the key.

Additive Cost Estimates

In this part, we define whether dates will be saved in the additive cost estimates.

The next and final tab of Costing Type is

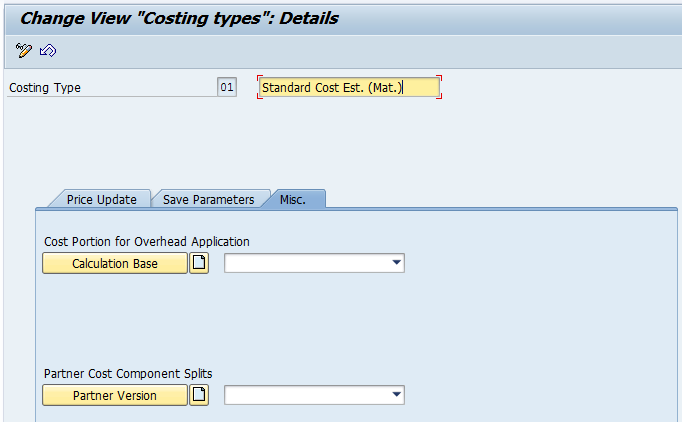

Tab: Misc

Cost Estimate with Quantity Structure

Here we have to select whether the date will be saved in standard cost estimate and following options are available for us to opt from:

- Without Date

- With date

- With Start of Period

This part becomes very important in case of product cost collect and hence, SAP has provided separate Costing Type for Product Cost Collector which contains relevant configuration to be opted for. Hence, it also becomes very important to identify the requirement and try to find if any standard costing type or costing variant is provided by SAP for the scenario (in most of the cases you will find the answer as YES) and if yes, go for it. If you do not find appropriate standard configuration, take a cautious approach while customising.

Note: For the standard cost estimate, you must update automatic costing with the With start of period indicator. This ensures that the results of the standard cost estimate can be used as the standard price for that period. For the other costing types, you can update the costing results with the With date indicator, for example. In this case the current date becomes part of the key.

Additive Cost Estimates

In this part, we define whether dates will be saved in the additive cost estimates.

The next and final tab of Costing Type is

Tab: Misc

This tab contains following two parts

Cost Portion for Overhead Application

This part works as a calculation base for calculating the overheads. Here we have to select the cost component view that will be used for calculating overheads (Costing Sheet).

Partner Cost Component Splits

Key that uniquely defines a combination of partner and direct partner.

An Advice

By defining the above information as per our requirement we can create the exact material cost estimate that suits business. But at the same time, care should be taken not to do modifications to the standard costing types or variants, instead copy the standard and create a new one. But SAP has already provided various standard costing types which meet most of our requirements and hence should be referred to before taking a decision to create a customised one.

List of standard Costing Types available:

With a hope that above information would help you in understanding various components under Costing Type and how they work.

In the next post under this series we will continue our discussion by taking up next component i.e. Valuation Variant.

Reference

SAP Help on Costing Type

You can see the visual demonstration of Costing Type in the following video:

Cost Portion for Overhead Application

This part works as a calculation base for calculating the overheads. Here we have to select the cost component view that will be used for calculating overheads (Costing Sheet).

Partner Cost Component Splits

Key that uniquely defines a combination of partner and direct partner.

An Advice

By defining the above information as per our requirement we can create the exact material cost estimate that suits business. But at the same time, care should be taken not to do modifications to the standard costing types or variants, instead copy the standard and create a new one. But SAP has already provided various standard costing types which meet most of our requirements and hence should be referred to before taking a decision to create a customised one.

List of standard Costing Types available:

- 01 - Standard Cost Est. (Mat.)

- 10 - Inv. Costing: Tax Law

- 11 - Inv. Costing: Comm. Law

- 12 - Mod. Std Cost Est. (Mat.)

- 13 - Ad Hoc Cost Estimates

- 19 - Product Cost Collector

With a hope that above information would help you in understanding various components under Costing Type and how they work.

In the next post under this series we will continue our discussion by taking up next component i.e. Valuation Variant.

Reference

SAP Help on Costing Type

You can see the visual demonstration of Costing Type in the following video:

RSS Feed

RSS Feed