In this part of the post, we are going to discuss about the Valuation Variant component of Costing Variant. This component is the most important of all due to the information controlled by this component in a Cost Estimate.

We will first see how this component looks like:

We will first see how this component looks like:

IMG Path: Controlling > Product Cost Controlling > Product Cost Planning > Material Cost Estimate with Quantity Structure > Costing Variant: Components > Define Valuation Variants

We are once again onto a structure with multiple tabs to divide the component into various logical parts. This as explained earlier plays a vital role in granular level of configuration required to meet client's requirement.

Before we go ahead, it would be interesting to understand the priority part which appears in most of the tabs. This is nothing other than the strategy or access sequence for determining the relevant object. We will see this in detail under explanation of each tab.

Now since we have seen how a Valuation Variant looks like, lets move ahead on understanding every tab one by one which will give us detailed understanding of every option available for use.

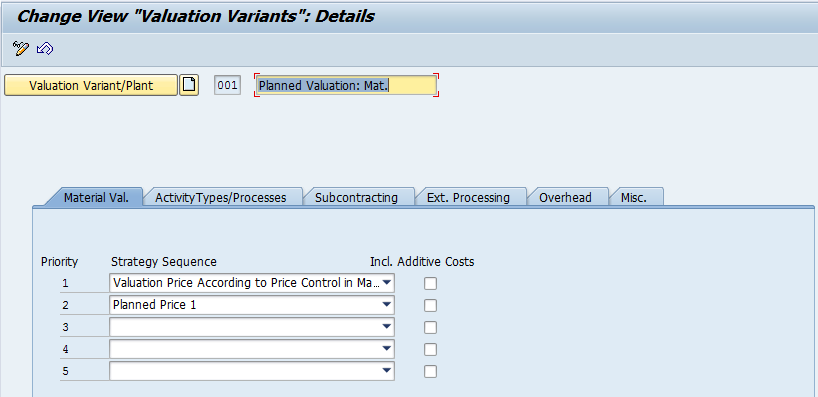

Tab: Material Val.

This tab as appearing in the above image helps us determine the basis for valuation of material value. Here SAP has provided an access sequence to identify the material value, for e.g. in the above screen we can see that Priority one has Valuation Price According to Price Control in Mat. Master and Priority Two is Planned Price 1. This prioritisation means, the system while creating cost estimate will first search for material price according to the price control indicator in the Component's master and if does not find anything then it will go and search Planned Price 1 field for Price of the component.

Few of the the options available are:

For e.g.

Select appropriate strategy to valuate Material with priorities so that system can fetch price from one of the strategies.

Note: This part is used to identify the cost of material (Raw Material/Packing Material/SFG) which will be used to manufacture the FG/SFG according to the Bill of Material (B.O.M.)

With this we will move on to the next tab

Tab: Activity Type/Processes.

First lets see how this tab looks like:

We are once again onto a structure with multiple tabs to divide the component into various logical parts. This as explained earlier plays a vital role in granular level of configuration required to meet client's requirement.

Before we go ahead, it would be interesting to understand the priority part which appears in most of the tabs. This is nothing other than the strategy or access sequence for determining the relevant object. We will see this in detail under explanation of each tab.

Now since we have seen how a Valuation Variant looks like, lets move ahead on understanding every tab one by one which will give us detailed understanding of every option available for use.

Tab: Material Val.

This tab as appearing in the above image helps us determine the basis for valuation of material value. Here SAP has provided an access sequence to identify the material value, for e.g. in the above screen we can see that Priority one has Valuation Price According to Price Control in Mat. Master and Priority Two is Planned Price 1. This prioritisation means, the system while creating cost estimate will first search for material price according to the price control indicator in the Component's master and if does not find anything then it will go and search Planned Price 1 field for Price of the component.

Few of the the options available are:

- Standard Price in Previous Period

- Standard Price

- Moving Average Price

- Planned Price 1

- Planned Price 2

- Planned Price 3

- Valuation Price According to Price Control in Mat. Master

For e.g.

- We can create one Valuation Variant where we can use Valuation Price According to Price Control in Mat. Master, this will be used to update material master.

- In addition to this, we may create another valuation variant with costing type to no update and keep material valuation strategy as Planned Price 1. This will give us the flexibility to forecast the cost of a particular material as per some price other than standard or MAP.

Select appropriate strategy to valuate Material with priorities so that system can fetch price from one of the strategies.

Note: This part is used to identify the cost of material (Raw Material/Packing Material/SFG) which will be used to manufacture the FG/SFG according to the Bill of Material (B.O.M.)

With this we will move on to the next tab

Tab: Activity Type/Processes.

First lets see how this tab looks like:

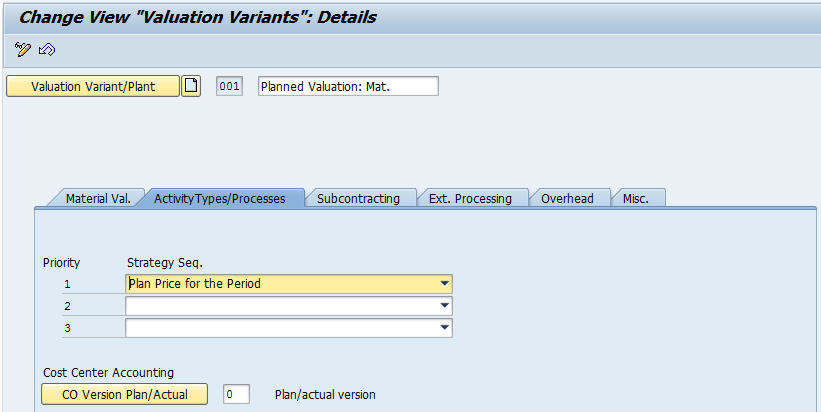

This tab contains configuration for strategy to determine the price for Activity Types/Processes. SAP has provided strategy with Priority here so that we can use more than one possibilities to determine the price in case first one does not contain any data.

Few of the options available are listed below:

Above options help us in great deal to decide the source of values for cost estimation.

With the strategy, we also define the CO Version for Cost Centre Accounting for Plan and Actual update.

Lets move to the next tab

Tab: Subcontracting

First lets see how this tab looks like:

Few of the options available are listed below:

- Plan Price for the Period

- Plan Price as average of all fiscal year periods

- Plan Price as average of remaining periods of the fiscal year

- Actual Price of previous period

- Actual price for the period

Above options help us in great deal to decide the source of values for cost estimation.

With the strategy, we also define the CO Version for Cost Centre Accounting for Plan and Actual update.

Lets move to the next tab

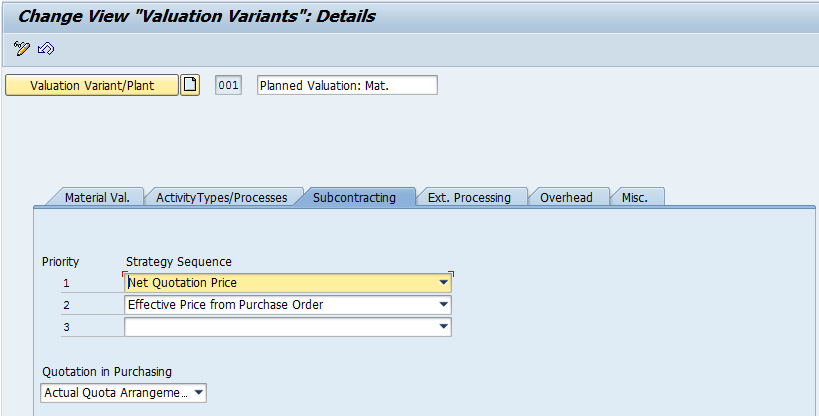

Tab: Subcontracting

First lets see how this tab looks like:

This tab contains configuration for strategy to determine the price for Subcontracting. SAP has provided strategy with Priority here so that we can use more than one possibilities to determine the price in case first one does not contain any data.

Few of the options available are stated below:

This tab helps to determine subcontracting cost, if any applicable for the product.

Lets move to the next tab

Tab: Ext. Processing

Lets see how this tab looks like:

Few of the options available are stated below:

- Net Quotation Price

- Gross Quotation Price

- Effective Price from Purchase Order

- Net Purchase Order Price

- Gross Purchase Order Price etc.

This tab helps to determine subcontracting cost, if any applicable for the product.

Lets move to the next tab

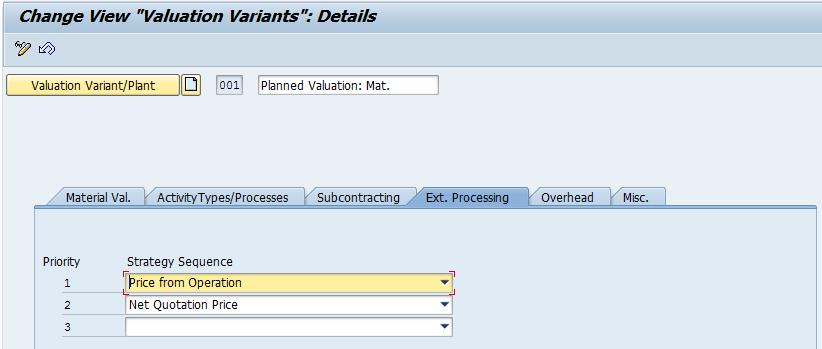

Tab: Ext. Processing

Lets see how this tab looks like:

Just like all the previous tabs, here also SAP has provided strategy sequence which means various options to choose from plus access sequence in case values are not available using one strategy.

Few of the options available are

Many of you may have question about what is difference between Subcontracting and External Processing, please click on the link to know the difference.

Now we will move on to the next tab

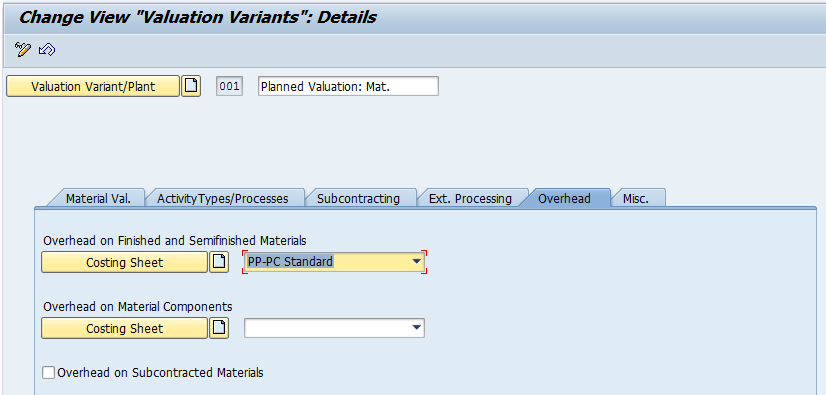

Tab: Overhead

Following image shows how this tab looks like

Few of the options available are

- Price from operation

- Net Quotation Price

- Gross Quotation Price

- Effective Price from Purchase Order

- Net Purchase Order Price

- Gross Purchase Order Price etc.

Many of you may have question about what is difference between Subcontracting and External Processing, please click on the link to know the difference.

Now we will move on to the next tab

Tab: Overhead

Following image shows how this tab looks like

This tab contains all the information related to overhead calculation relevant to the product.

This part is divided into two assignments

Overhead on Finished and Semifinished Materials

Here we can assign the Costing Sheet which calculates overhead costs of the product.

Overhead on Material Components

Here we can assign Costing Sheet for allocating Overheads and Process costs to Raw Material. The costing sheet enables you to allocate overhead to raw materials.

Note:

Overhead can only be allocated to raw materials in planning data, not in actuals.

At the same time we can notice the radio button Overhead on Subcontracted Material, activate this if you want the Costing Sheet to be applied to the subcontracted material.

The next and the last tab in Valuation Variant is explained below:

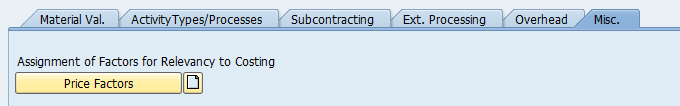

Tab: Misc.

This part is divided into two assignments

Overhead on Finished and Semifinished Materials

Here we can assign the Costing Sheet which calculates overhead costs of the product.

Overhead on Material Components

Here we can assign Costing Sheet for allocating Overheads and Process costs to Raw Material. The costing sheet enables you to allocate overhead to raw materials.

Note:

Overhead can only be allocated to raw materials in planning data, not in actuals.

At the same time we can notice the radio button Overhead on Subcontracted Material, activate this if you want the Costing Sheet to be applied to the subcontracted material.

The next and the last tab in Valuation Variant is explained below:

Tab: Misc.

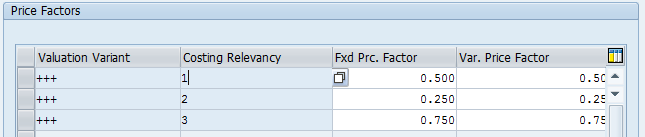

This tab does not have any direct configuration in the valuation variant, rather the configuration done using this tab can be used in Routing/Recipe to determine the relevance of cost i.e. if the 100% of the cost (Activities etc.) should be applied during cost estimate.

We can create various costing relevancy and maintain it's percentages. The system calculates cost according to these percentages.

We can create various costing relevancy and maintain it's percentages. The system calculates cost according to these percentages.

SAP has provided following standard Costing Relevancy:

No Relevance

25% relevant

50% relevant

75% relevant

100% relevant

Select the appropriate option in Recipe/Routing and the system will calculate values based on the relevancy.

Hope above information helps you to understand how Valuation Variant is to be configured.

No Relevance

25% relevant

50% relevant

75% relevant

100% relevant

Select the appropriate option in Recipe/Routing and the system will calculate values based on the relevancy.

Hope above information helps you to understand how Valuation Variant is to be configured.

RSS Feed

RSS Feed