Definition

In Financial Accounting the financial statements can be drawn monthly, quarterly, semi annually or annually. The financial statements are drawn after various adjustments, provisions etc. In order to ensure that the financial statements drawn are same though it is essential to restrict any posting of documents in the period for which statements are done. SAP has provided a special provision in the form of Posting Period Variant. The purpose of Posting Period Variant is to restrict the posting of documents to appropriate period.

In Financial Accounting the financial statements can be drawn monthly, quarterly, semi annually or annually. The financial statements are drawn after various adjustments, provisions etc. In order to ensure that the financial statements drawn are same though it is essential to restrict any posting of documents in the period for which statements are done. SAP has provided a special provision in the form of Posting Period Variant. The purpose of Posting Period Variant is to restrict the posting of documents to appropriate period.

Implementation consideration

Defining of Posting Period Variant

IMG Path: Financial Accounting (New) > Financial Accounting Global Settings (New) > Ledgers > Fiscal Year and Posting Periods > Posting Periods > Define Variants for Open Posting Periods

Assignment to Company Code

IMG Path: Financial Accounting (New) > Financial Accounting Global Settings (New) > Ledgers > Fiscal Year and Posting Periods > Posting Periods > Assign Variants to Company Code

Info ahead

Posting Period Variant can be centralized or deccentralised Centralised assignment of Posting Period to Company Code is done when the periods for all the company codes are to be closed together and posting periods do not differ for various company codes. Decentralised assignment is done when periods for the company codes are to be opened/closed separately. In most of the cases, separate posting period variants are created for different company codes.

In order to understand Posting Period Variant, it is very important to first understand Account Types. The Account Types differentiates various types of accounts. Given below is the list of Account Types available in SAP

Acct Type Remarks

+ Valid for all account types

A Assets

K Vendors

D Customers

M Material

S General Ledger

In above account types, the account type “+” is a special Account Type which marks perimeter for which we want to open the periods. All other Accounts Types need to have periods within the periods mentioned in “+”. The functionality of different Account Types, helps Finance Manager to open different periods for different account types.

Example

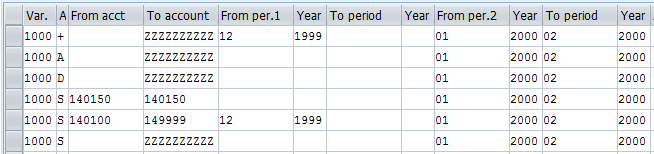

The image at the bottom along with the explanation below would help you understand how OB52 works

Tip

For account types D and K, you specify the numbers of the reconciliation accounts rather than those of the customer and vendor accounts themselves. This entry determines the posting periods permitted for the sub-ledger accounts.

Reference Material

Posting Period

Tags#

SAP Account Types, SAP Assign Posting Period Variant, SAP Posting Period Variant

Defining of Posting Period Variant

IMG Path: Financial Accounting (New) > Financial Accounting Global Settings (New) > Ledgers > Fiscal Year and Posting Periods > Posting Periods > Define Variants for Open Posting Periods

Assignment to Company Code

IMG Path: Financial Accounting (New) > Financial Accounting Global Settings (New) > Ledgers > Fiscal Year and Posting Periods > Posting Periods > Assign Variants to Company Code

Info ahead

Posting Period Variant can be centralized or deccentralised Centralised assignment of Posting Period to Company Code is done when the periods for all the company codes are to be closed together and posting periods do not differ for various company codes. Decentralised assignment is done when periods for the company codes are to be opened/closed separately. In most of the cases, separate posting period variants are created for different company codes.

In order to understand Posting Period Variant, it is very important to first understand Account Types. The Account Types differentiates various types of accounts. Given below is the list of Account Types available in SAP

Acct Type Remarks

+ Valid for all account types

A Assets

K Vendors

D Customers

M Material

S General Ledger

In above account types, the account type “+” is a special Account Type which marks perimeter for which we want to open the periods. All other Accounts Types need to have periods within the periods mentioned in “+”. The functionality of different Account Types, helps Finance Manager to open different periods for different account types.

Example

The image at the bottom along with the explanation below would help you understand how OB52 works

- Specify the minimum entry + to open the periods you need for all your accounts.

- For your customer and vendor accounts, use the reconciliation accounts to specify the permitted posting periods. To do this, enter the account type in the column headed A. Then specify the permitted posting periods for the desired account number interval.

- For account 140150, specify only the current and the following period.

- For the interval 140100 to 149999, specify the current, the following and the previous period.

- Open the current period and the following period for all your G/L accounts by entering an account

- number interval containing all account numbers.

Tip

For account types D and K, you specify the numbers of the reconciliation accounts rather than those of the customer and vendor accounts themselves. This entry determines the posting periods permitted for the sub-ledger accounts.

Reference Material

Posting Period

Tags#

SAP Account Types, SAP Assign Posting Period Variant, SAP Posting Period Variant

RSS Feed

RSS Feed