Payment term is a part of accounts receivable component that helps you keep track of your receivables more effectively.

They play a vital role in identifying the exact receivable amounts as on a particular date

They play a vital role in identifying the exact receivable amounts as on a particular date

Background

Any business operates as you very well know on revenue. The revenue is what helps any business grow and prosper exponentially. Inability to grow revenue hampers business. This must be true, but apart from revenue, there is one more thing that is as important as revenue for any business, COLLECTION. It means, it is not just important to sell any product, but also to recover money from the customer.

The business, everyday, lures its customers by throwing many offers / schemes for buying more and more, but if the money is not collected against this sale, then the business may face a big cash crunch. Hence, it becomes utmost important to get money from customers in time and Payment terms help us in this matter.

Definition

A payment term is a key that contains configuration regarding calculation of date on which payment becomes due from the customer based on certain prerequisites. The payment term calculates something called net due date which is nothing but the date on which customer is bound to pay the amount.

Use

The payment term not just helps to keep check on the recovery of amounts but also helps in drawing many trends like payment receivable from customers in next 30 days, 60 days, 90 days etc. In other words it helps to prepare Customer Ageing report which assists business to draw a cash flow for future transactions.

Implementation Consideration

IMG Path: Financial Accounting (New) > Accounts Receivable and Accounts Payable > Business Transactions > Outgoing Invoices/Credit Memos > Maintain Terms of Payment

Before we proceed further we must understand some of the basics of payment terms in order to configure the same:

Document Date

This is the date of the document which is getting posted. This can be customer's invoice date.

Posting Date

This is the date on which document is getting posted in the system

Entry Date

This is the physical date of the server on which document is getting posted in the system

Baseline Date

This is a date, from which payment due date is getting calculated by adding the credit period

Net Due Date

This is the date on which the payment becomes actually due for receipt from customer

Now we will go further to configuration of Payment Terms.

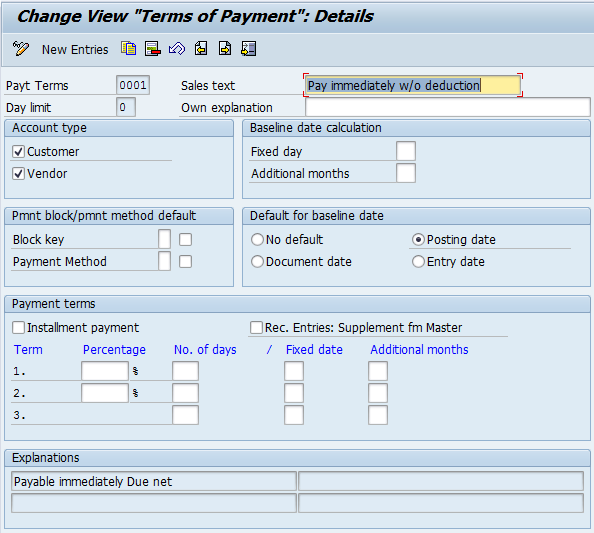

Given below is the screenshot of the standard payment term "0001" which comes with standard SAP. We will look into details of this payment terms

Payment Terms

This is the code of Payment Terms that we want to create. You are advised to copy the existing payment terms and create new ones starting with "Z". This will help you identify the payment terms to be followed by your business.

Sales Text

Description of terms of payment

Day Limit

This is a special field which we miss many a times. Here we can specify the parts of the months based on which baseline date is to be calculated. For e.g. All the invoices raised on customers from 1st to 15th of the month are to be paid within 30 days from 15th day. This condition is possible using Day Limit.

Own Explanation

Explanation of the terms of payment which is different to the automatically created explanations.

Account Type

Select if this payment term will be applicable in case of Vendors or Customers

Fixed Day

Calendar day with which the system overwrites the day of the baseline date for payment of the line item.

Additional Months

Number of months which the system adds to the calendar month of the baseline date for payment.

Block Key

Default value for the payment blocking key. In addition to the default block key, we have an option to make the block key default by selecting the radio button just next to default payment block.

Payment Method

The payment method determines how payments are to be made, e.g. by check, bank transfer or bill of exchange. Also just like Block Key, we have option to default the payment method as well.

Default for Baseline date

SAP has provided following dates to consider for default date for baseline dates

No Default: In this case, the baseline date is to be entered during entry, select this option

Posting Date: Select this option if posting date is to be calculated as baseline date

Document Date: Select this option if document date is to be calculated as baseline date

Entry Date: Select this option if entry date is to be calculated as baseline date

Installment Payment

Indicator that the invoiced amount is to be broken down into partial amounts with different due dates

Set this indicator if several items with different due dates are to be generated from one line item when using this payment term. In order to make this indicator works, further configuration is required to specify which payment terms are to be valid for the resulting partial amount for each percentage rate.

Recurring Entries

This indicator controls whether the terms of payment in a recurring entry are to be taken from the customer or vendor master record, if no terms of payment key has been entered in the recurring entry original document.

Cash Discount Percentage

Cash discount percentage rate which is granted for payment within the specified period. This period is to be entered in the next column of number of days provided. We can provide only two cash different cash discounts in once payment term. If further break-up is required, use installment payment configuration.

Fixed Date for Cash Discount

We can alternatively provide the fixed calendar day to calculate the cash discount percentage.

Additional Month

Addition of month to the fixed date for cash discount calculation

Hope above explanation will help you configure Payment Terms. We will try to bring more insight on the same in coming days.

This is the code of Payment Terms that we want to create. You are advised to copy the existing payment terms and create new ones starting with "Z". This will help you identify the payment terms to be followed by your business.

Sales Text

Description of terms of payment

Day Limit

This is a special field which we miss many a times. Here we can specify the parts of the months based on which baseline date is to be calculated. For e.g. All the invoices raised on customers from 1st to 15th of the month are to be paid within 30 days from 15th day. This condition is possible using Day Limit.

Own Explanation

Explanation of the terms of payment which is different to the automatically created explanations.

Account Type

Select if this payment term will be applicable in case of Vendors or Customers

Fixed Day

Calendar day with which the system overwrites the day of the baseline date for payment of the line item.

Additional Months

Number of months which the system adds to the calendar month of the baseline date for payment.

Block Key

Default value for the payment blocking key. In addition to the default block key, we have an option to make the block key default by selecting the radio button just next to default payment block.

Payment Method

The payment method determines how payments are to be made, e.g. by check, bank transfer or bill of exchange. Also just like Block Key, we have option to default the payment method as well.

Default for Baseline date

SAP has provided following dates to consider for default date for baseline dates

No Default: In this case, the baseline date is to be entered during entry, select this option

Posting Date: Select this option if posting date is to be calculated as baseline date

Document Date: Select this option if document date is to be calculated as baseline date

Entry Date: Select this option if entry date is to be calculated as baseline date

Installment Payment

Indicator that the invoiced amount is to be broken down into partial amounts with different due dates

Set this indicator if several items with different due dates are to be generated from one line item when using this payment term. In order to make this indicator works, further configuration is required to specify which payment terms are to be valid for the resulting partial amount for each percentage rate.

Recurring Entries

This indicator controls whether the terms of payment in a recurring entry are to be taken from the customer or vendor master record, if no terms of payment key has been entered in the recurring entry original document.

Cash Discount Percentage

Cash discount percentage rate which is granted for payment within the specified period. This period is to be entered in the next column of number of days provided. We can provide only two cash different cash discounts in once payment term. If further break-up is required, use installment payment configuration.

Fixed Date for Cash Discount

We can alternatively provide the fixed calendar day to calculate the cash discount percentage.

Additional Month

Addition of month to the fixed date for cash discount calculation

Hope above explanation will help you configure Payment Terms. We will try to bring more insight on the same in coming days.

RSS Feed

RSS Feed